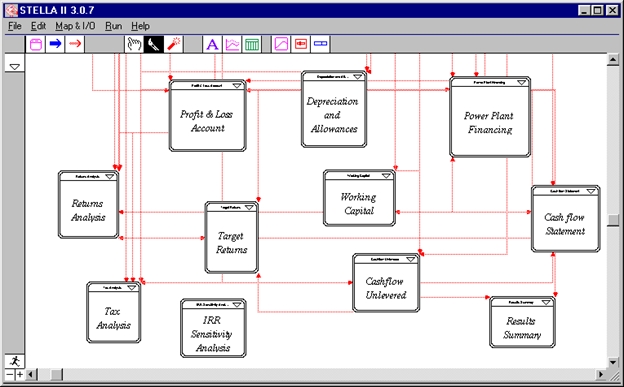

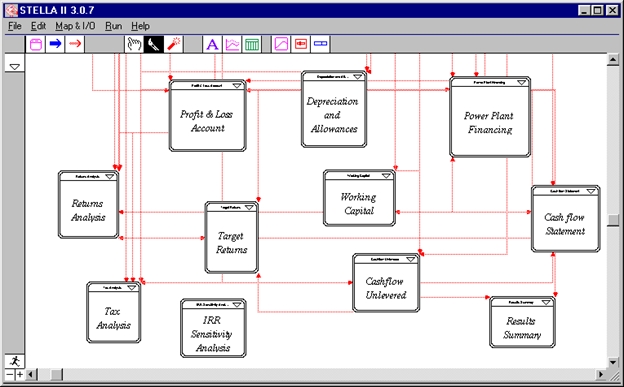

Figure 1. A Window View of Financial Module in StellaTM

Abstract

This paper is concerned with the use of System Dynamics [SD] in the commercially important area of the appraisal of investment projects. The fundamental question addressed was whether the SD approach and the related software packages, in this particular case StellaTM, can be used in such a commercially sensitive and calculation demanding applications (Anon, 1996; ). Insights into the broader applicability of SD were gained. An existing MS Excel spreadsheet model, developed to assist the investment appraisal analysis of large power plant projects, has been fully transformed into a prototype application using System Dynamics modelling characteristics of StellaTM II. The comparison of the results obtained by the two versions shows that the prototype StellaTM II-based investment appraisal model has achieved a 100% accuracy in all variables, with no calculation-related bugs and/or errors being detected.

Key words: Investment Appraisal Model, System Dynamics, Spreadsheets, StellaTM, MS Excel, Prototype Application, Power Plant.

South Bank University has completed a contract with a major global Independent Power Producer (IPP) company that plays an important role in the UK electricity industry, to develop a version of their current spreadsheet based investment appraisal model using the System Dynamics (SD) approach and utilising the StellaTM software tool. Two areas of the business are explicitly dynamic in its nature - the yearly power plant operation, and the financial performance over the life span of the project. With regard to project capacity planning, system capacity planning, and project investment appraisal, over the years, both areas have been subject of intensive system dynamics and simulation modelling (Kahn, 1988).

There were two motives for the client organisation to participate in such a project. Firstly, the spreadsheet model has suffered from well recognisable problem symptoms connected with overall control, documentation and logical errors (Freeman, 1996, Clarke & Tobias, 1995). The structure of input data & assumptions, calculation, and reporting functionalities has also become unsustainable. Secondly, the management wished to explore possibilities of further enhancements to their investment appraisal model. Particularly, the management was keen to explore possible generic characteristics of the SD modelling with regard to: generality of plant size and configuration; flexibility of operating regimes, turbine cycles and capital costs estimates; evaluation of alternative tax and financial optimisation scenarios; and the minimisation of the degree of customisation. In more general terms, the management was also willing to experiment with the use of the SD and the system thinking techniques in an analysis of investment decision-making behaviour. The authors were interested in applicability of SD models in this problem domain, and comparison of the spreadsheet and SD models (this is examined in more details in a separate paper - Kennedy, 1996). The ultimate goal of both parties was, however, to produce a functioning, StellaTM -based, prototype investment appraisal software application. Under the supervision of M. Kennedy, the spreadsheet decoding and the StellaTM modelling, simulation and analysis was done by V. Savicic as part of his MSc dissertation.

We were uncertain as to the capabilities, capacities and behaviour of StellaTM with regard to investment appraisal analysis. This uncertainty has put a significant constraint on the original aim of the research. We were aware of the criticism from some authorities that SD gives indicative results (Ansoff and Slevin, 1968; Sharp and Prince, 1984). The numerical accuracy of the results from the SD model constructed was of critical importance in this application. Even if the StellaTM was capable of integrating all variables and the underlying logic, and performing all calculations, the question was what to accept as a criterion for the evaluation of the validity of the SD model. After a series of consultations and the system thinking type of evaluation (Rothman, 1996), the conclusion was to try to develop a functioning prototype application (Curtis, 1995) in StellaTM by replicating the logical relationships of the existing spreadsheet-based investment appraisal model. The model would then be tested by repeating the evaluation of a 750 MW power plant and comparing the results from the two models.

The original spreadsheet model was developed in MS Excel. In two separate files, one of them having four major sheets, the model integrates about 1000 variables in total. The data and the calculations are extensively linked between the files and the sheets in order to preserve the logic of the model. The total capacity of the two files is 800 KB. An implicit analysis of the model, and discussions with the client, showed that the input data and assumptions, calculation and reporting functionalities have all been developed in an ad- hoc way without consideration of the potential long-term effects. Some parts of the model are used occasionally, reflecting project-specific and/or client-specific needs. The significant number of variables is repeated in different sub-models under different names, with, in most cases, a long string of characters being used for explanatory purposes. The advantages of object design modelling and object linking and embedding (Wells, 1995) provided by Visual Basic for Applications and other MS Office applications have not been used at all. Because of the adopted replication approach, in the latter stage of the research the inefficient and ineffective structure had significant consequences for the prototype developed in StellaTM.

The System Dynamics Model has been developed in a single StellaTM file of 3.6 MB of capacity, completely preserving the logic of the Excel model. By adopting the specifically designed modular approach that relies on a number of sectors, the developer was capable of evaluating the performance of the StellaTM in stages, comparing it with the results of the case study analysis obtained by the spreadsheet calculation. Finally, the whole prototype was completed successfully within a 720-hours schedule. The both models were applied in the investment appraisal analysis of a 750 MW combined gas and steam cycle plant, using the same actual technical, economic and financial data. The comparison of the results obtained by the two versions shows that the prototype StellaTM II-based investment appraisal model has achieved a 100% accuracy in all variables, with no calculation-related bugs and/or errors being detected. The basic simulation process of the SD model was designed to cover 20 years of the project life, but several simulations designed with the different (smaller) time scale were also needed to incorporate either quarterly or yearly-specific calculations of the spreadsheet. The basic simulation lasts 1-2 minutes, mostly due to the extensively used graphical presentation of the results (see Figure 1. as an example). Minimum requirements for running the prototype are: Windows 95, 16 MB of RAM and Stella II 3.0.7 Version.

Two major complexities were encountered during the development process. Firstly, the direct incorporation of the quarterly calculations into the basically yearly simulation proved to be a non-elegant and an inefficient solution, which led to the fragmentation of the related sheet into the constants. Secondly, only about 30% of the model (mainly the Plant Performance Module), could be developed on a single module at a time basis. For the remaining majority (particularly the Financial Module), several (occasionally 7-10) sectors needed to be developed simultaneously. There were also several significant disadvantages related to the version of the StellaTM application utilised [II 3.0.7], some of which have been addressed in subsequent releases (HPS, 1994). These are the incapacity to deal with the string type of variables, incapacity to incorporate the array function, unavailability of strait forward IRR function, incapacity of file linking, and inadequate debugging characteristics. All of this, coupled with the inefficiency of the original model, contributed to the inefficient use of memory and relative difficulties regarding the inside-file management. Also, for an unknown reason, once the model had reached a considerable size the StellaTM was not able to display the complete code of the prototype, although the simulation functioned correctly. The major advantages of the SD prototype are however very significant. The most useful of them is greater robustness capacities in terms of protection of data from negligence and/or misuse. The advantages also include the greater applicability in the context of multiple options analysis and the risk analysis, and greater documentation and graphic presentation capabilities.

The project shows that the StellaTM can be a very useful tool in the investment appraisal purposes. However, a structured work plan and the co-ordinated effort of all interested parties is needed for the development of an efficient and user-friendly investment appraisal application. Our experience in replicating excel models into STELLA environment, appears to place doubt on the criticisms that SD gives indicative results (Ansoff and Slevin, 1968; Sharp and Prince, 1984). The numerical accuracy of results in SD models depends on the completeness and correctness of the data used.

Figure 1. A Window View of Financial Module

in StellaTM

REFERENCES: For a list of references see the virtual proceedings